Technical Tip

A GST Description can be set in company configuration to change “GST” to another tax label such as “VAT”, for example. Where this is set, all references to GST would appear as VAT. For more information, see "Edit - Program - General".

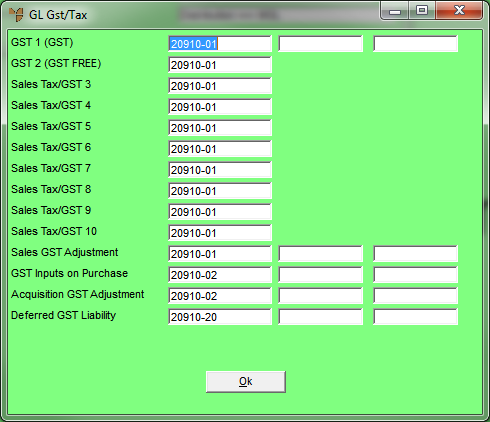

You use the GL GST/Tax screen to setup your GL interface (integration table) for MDS customer and supplier transactions involving tax and GST so that financial data is transferred automatically to the correct accounts in MGL. This table contains the appropriate GL accounts so that Micronet can accumulate liability and credit amounts for tax purposes.

|

|

|

Technical Tip A GST Description can be set in company configuration to change “GST” to another tax label such as “VAT”, for example. Where this is set, all references to GST would appear as VAT. For more information, see "Edit - Program - General". |

To setup your GL interface for transactions involving tax and GST:

Refer to "Adding a New GL Interface Record" or "Updating a GL Interface Record".

Micronet displays the GL Gst/Tax screen.

|

|

Field |

Value |

|---|---|---|

|

|

GST 1 (GST) |

Enter the main account for GST collected from customers. This GL account is used to record the GST component on customer invoices and credit notes. This account posts a credit (increasing liabilities) to the Current Liabilities section of the Balance Sheet. |

|

|

|

Technical Tip The two fields next to each field on this screen are for entry of T1 and T2 accounts. If your company uses T accounts to flag transactions for GL reporting, enter the default T1 account for the GL account in the first field and the default T2 account for the GL account in the second field. You can also press spacebar then Enter to select these T accounts. For more information about T accounts, see "T Accounts". |

|

|

GST 2 (Free) |

|

|

|

Sales Tax/GST 3, 4, 5, 6, 7, 8, 9, 10 |

These accounts relate to other taxes collected under the GST regime that relate to sales, such as WET (Wine Equalisation Tax). Enter the GL accounts used to record the GST or WET component on customer invoices and credit notes. These accounts post a credit (increasing liabilities) to the Current Liabilities section of the Balance Sheet. The tax code labels displayed in these fields are user defined. For more information, refer to "Edit Company - Edit - Tax Tables". |

|

|

Sales GST Adjustment |

GST sales adjustments are usually transactions such as discounts, price adjustments or the write-off of bad debts. Enter the GL account used to record the GST component of the adjustment being made through debtor (customer) journals or payments. This account posts a credit (increasing liabilities) or a debit (reducing liabilities) against the GST Collected amounts payable in the Balance Sheet. |

|

|

GST Inputs on Purchase |

Enter the main GL account for GST Paid for stock suppliers. This account is used to record the GST component on supplier invoices and credit notes. This account posts a debit (reducing liabilities) to the Current Liabilities section of the Balance Sheet. |

|

|

Acquisition GST Adjustment |

GST Acquisition Adjustments are usually transactions such as discounts, price adjustments or corrections. Enter the GL account used to record the GST component of the adjustment being made through supplier and creditor journals or payments. This account posts a debit (reducing liabilities) or a credit (increasing liabilities) against the GST Paid amounts payable in the Balance Sheet. |

|

|

Deferred GST Liability |

Enter the account for deferred GST related to import costing. For more information on deferred GST, see "Interface Record for Deferred GST". |

Micronet redisplays the Change GL Interface screen.